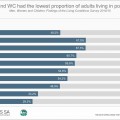

Five facts about poverty in South Africa

The Living Conditions Survey (LCS) is part of Stats SA’s household survey programme and provides detailed information on households’ living circumstances, as well as their income and expenditure patterns. Information from this survey was used to compile the report Men, Women and Children: Findings of the Living Conditions Survey 2014/15. Let’s take a look at read more »

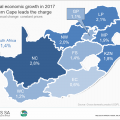

Four facts about our provincial economies

Each province is unique. Data published recently by Stats SA provide a portrait of South Africa’s provincial economies. Here are four facts you might not have known about our economic landscape. Fact #1 Gauteng is South Africa’s economic powerhouse Don’t let Gauteng’s size on a map fool you. It might be the province with read more »

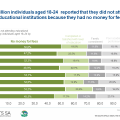

More than half of youth have no money to pay for their tuition

More than half (or 51%) of youth aged 18–24 claimed that they did not have the financial means to pay for their tuition. Furthermore, 18% of those aged 18–24 who were not attending educational institutions indicated that their poor academic performance prevented them from participating. This is according to the “Higher Education and Skills in read more »

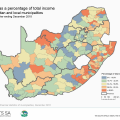

How financially independent are municipalities?

Spending and income play an important role in determining local government’s ability to deliver services. The ability of a municipality to generate its own income is an important sign of its independence. The Quarterly Financial Statistics of Municipalities (QFSM) survey collects data on municipal operating expenditures and incomes on a quarterly basis. The December 2018 read more »

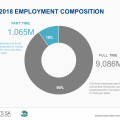

SA formal sector jobs increased in the fourth quarter of 2018

The December 2018 QES survey showed that an estimated 10 151 000 people were employed in the formal non-agricultural sector of the South African economy, which is up by 87 000 from 10 064 000 in the previous quarter. The number of people working part-time increased by 37 000 to 1 065 000 in the read more »

Medical aid and transport costs nudge inflation higher

Consumer inflation edged up slightly from 4,0% in January 2019 to 4,1% in February 2019, remaining firmly within the South African Reserve Bank (SARB) inflation target range of 3%–6%. Notable drivers behind the rise were medical insurance and transport costs. Stats SA surveys health insurance fees in February of each year. On average, medical-aid schemes read more »

Government finances: surplus, deficit and debt

Believe it or not, there was a time – not so long ago – when the South African government actually spent less than it earned. Stats SA takes a look at government spending over 13 years, focusing on how much we pay to service our debt. Harking back to better times in February’s National Budget read more »

How do tourists spend their money?

Fancy a meal out, or would you rather save up for accommodation when on holiday? We take a peek into the spending habits of domestic and international visitors who criss-cross the South African landscape. Visitors1 spent just over half a million rand every minute during the course of 2017! That amounts to R277 billion for the read more »

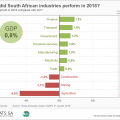

Economy edges up by 0,8% in 2018

The South African economy grew by 1,4%1 in the fourth quarter of 2018, contributing to an overall growth rate of 0,8% for the entire year. The latest set of gross domestic product (GDP) figures released by Stats SA provides an overview of economic performance in 2018. South Africa found itself in economic recession in 2018, read more »

Falling fuel prices drag inflation down

Consumer inflation dropped to 4,0% in January 2019 from 4,5% in December 2018. This is the lowest annual rate since March 2018, when headline inflation came in at 3,8%. The actual index level is now lower than it was in October 2018, according to Stats SA’s latest Consumer Price Index release1. This means that, on average, read more »