Rural municipalities continue to depend on government for revenue

Rural municipalities continue to rely heavily on national government to finance their budgets, according to data from the latest release of Stats SA’s Financial census of municipalities report.

For every R1 of revenue received by municipalities in the year 2014, 33c was in the form of grants and subsidies from national and provincial government. The remaining two-thirds of revenue were generated by municipalities themselves, with major sources including sales of electricity (29c for every R1), property rates (15c for every R1), sales of water (9c for every R1), and sanitation charges (3c for every R1)1.

On the surface, it might seem that local municipalities are in a reasonably good position, being able to self-finance two-thirds of their revenue. However, a more nuanced picture emerges if the financial data are broken down by type of municipality.

The Municipal Infrastructure Investment Framework (MIIF) divides local and metropolitan municipalities into five groups. These are: metropolitan municipalities/large cities (A); secondary cities (B1); municipalities with a large town as its core (B2); municipalities with small towns (B3); and municipalities that are predominantly rural (B4)2.

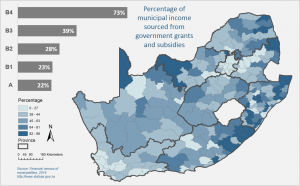

An analysis of Stats SA’s municipal financial data according to these groups shows the extent to which rural municipalities depend on grants and subsidies. This form of revenue contributed 73% of total revenue received by B4 municipalities in 2014. The map below shows high percentages for municipalities falling in the former ‘homelands’, in particular the former Transkei and Ciskei.

The three municipalities relying the most on government grants were Hlabisa and Vulamehlo in KwaZulu-Natal (95,9% and 95,0% respectively), and Ntabankulu in Eastern Cape (93,5%).

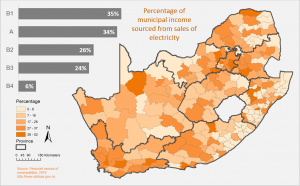

The main source of revenue for predominantly urban municipalities (A and B1), on the other hand, was from sales of electricity3.

It could be argued that, if municipalities were less dependent on grants and subsidies, those funds could be used by national and provincial government to address other priorities. It could also reduce the tax burden on individuals and companies. A fall in the proportion of revenue from government would be an indication that a municipality is exhibiting a greater degree of sustainability, development and growth with resources generated from its own income base.

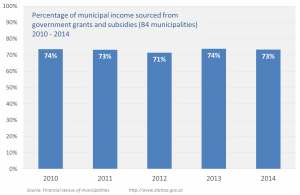

The chart below shows that the dependence of B4 municipalities on grants and subsidies has remained relatively stable. For every R1 that B4 municipalities received as revenue in 2010, 74c was from national and provincial government. This decreased slightly to 73c in 2014.

1 Download the Financial census of municipalities report here.

2 Download the Municipal Demarcation Board’s State of Municipal Capacity Assessment 2010/2011: National trends in municipal capacity report here

3 The provision of services, such as electricity, water, sewerage and sanitation, requires significant capital expenditure in infrastructure. Stats SA will release the latest Capital expenditure by the public sector report on 29 July 2015, which will include data for all public institutions, including municipalities.