South Africa’s Informal Economy: A Lifeline for Millions

South Africa’s informal sector plays a crucial yet often overlooked role in the country’s economy, providing jobs and incomes for millions who struggle to find opportunities in the formal labour market. According to the latest Quarterly Labour Force Survey (QLFS) released by Statistics South Africa (Stats SA), informal sector employment accounted for 19,5% of total employment in the fourth quarter of 2024, cementing its status as the second-largest source of jobs after the formal sector.

Statistics South Africa conducted a Survey of Employers and Self-Employed (SESE) in 2023. The Survey collects information on businesses not registered for value added tax (VAT). These businesses are referred to as businesses in the informal sector.

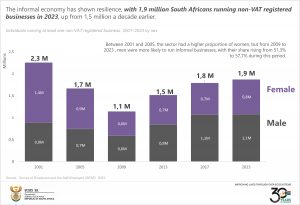

Despite economic uncertainties, the informal economy has shown resilience, with 1,9 million South Africans running non-VAT registered businesses in 2023, up from 1,5 million a decade earlier. This sector is particularly vital for those with limited formal education, as more than half of informal business owners across all provinces- except the Western Cape (45,3%)- had not completed matric.

Who Works in South Africa’s Informal Sector?

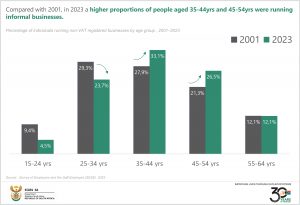

South Africa’s informal sector is evolving, with a growing number of older individuals stepping into the informal sector. In 2023, the proportion of people aged 35–64 years running informal businesses increased compared to 2001. The most notable rise was seen among those aged 35–44 years, climbing from 27,9% in 2001 to 33,1% in 2023.

Demographically, Black Africans continue to dominate the informal business space, making up 88,9% of business owners in 2023. While this is slightly lower than the 90,8% recorded in 2017, it still reflects the group’s strong presence in the sector. Meanwhile, the Indian/Asian population saw a decline in participation between 2017 and 2023, while the white population recorded a modest increase of 2,3 percentage points over the same period. The Coloured population’s share remained largely unchanged.

Geographically, the informal sector is most concentrated in Gauteng (28,9%), followed by KwaZulu-Natal (16,8%) and Limpopo (15,8%). However, five out of nine provinces have seen a decline in informal businesses since 2001.

Unemployment remains the leading reason people start informal businesses, with women being the most disproportionately affected. In 2001, 64,1% of women cited joblessness as their primary reason for running an informal sector business; by 2023, the percentage remained significant at 58,9%.

Informal Sector: Industries, Locations, and Challenges

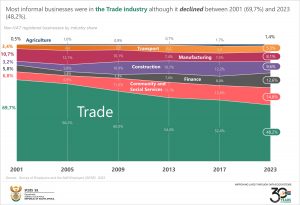

South Africa’s informal sector has long been dominated by the trade industry, but its influence is gradually declining. In 2001, nearly 70% (69,7%) of informal businesses operated in trade; by 2023, this had dropped to 48,2%. While trade remains the largest informal industry, other industries have been on the rise. Services, finance, construction, transport, and agriculture have all seen growth, reflecting a shift in economic activity among informal sector businesses.

The locations where these businesses operate have also changed over time. In 2023, the majority (27,9%) of informal businesses were run from the owner’s home, often in a dedicated space. A small but notable proportion (3,3%) operated from another person’s dwelling. This figure had risen slightly from 1,5% in 2001 to 3,8% in 2017 before dipping again in 2023. Businesses based in transportation hubs have remained relatively stable, with minor fluctuations over the years—standing at 3,3% in 2001, peaking at 5,4% in 2009, and reaching 4,6% in 2023.

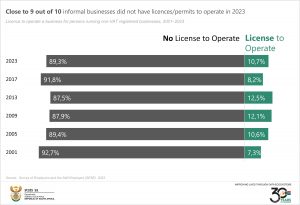

Regulation remains a challenge for informal businesses, with most operating without official permits. The proportion of owners with licences rose from 7,3% in 2001 to 12,5% in 2013, then declined to 8,2% in 2017, before slightly recovering to 10,7% in 2023. Most of those who run informal businesses obtained their licences from municipal or provincial authorities (44,1%), followed by business associations (28,3%) and professional bodies (24,4%).

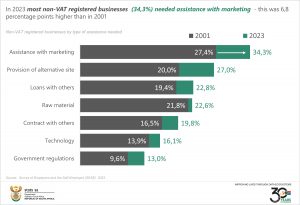

Despite their resilience, informal businesses continue to face hurdles, particularly in marketing and securing space to operate. In 2023, 34,3% of informal sector businesses needed marketing support—an increase of 6,8 percentage points since 2001. The demand for alternative business sites also saw the sharpest rise, growing by 7 percentage points to 27%

From street vendors to home-based enterprises, informal businesses sustain households, contribute to local economies, and reflect the country’s entrepreneurial spirit. As the sector grows, so do the challenges—limited access to funding and licensing issues remain pressing concerns. As South Africa’s informal sector adapts to changing economic conditions, these businesses remain a vital source of employment and income for many.

For more information, download the Survey of Employers and the Self-Employed (SESE) here.