South Africa Sees Modest Job Growth Amid Year-Long Decline

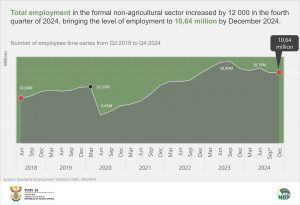

After a challenging year of job losses, South Africa’s formal non-agricultural sector showed a glimmer of recovery in the final quarter of 2024. According to the Quarterly Employment Statistics (QES, Q4:2024) survey released by Statistics South Africa (Stats SA), employment in the sector rose by 12 000 jobs, reaching 10,64 million by December 2024. This modest 0,1% increase comes despite a notable year-on-year decline of 91 000 jobs since December 2023.

The trade industry led the increase, adding 42 000 jobs, with business services following with 22,000 new jobs. Not all sectors shared in the gains. The community services industry experienced the largest decline, shedding 26 000 jobs, while construction and manufacturing each saw losses of 13 000 positions.

Full-Time Employment Sees a Slight Increase Amid Sectoral Declines

Full-time employment in the country saw an increase of 10,000 jobs in the final quarter of 2024, rising from 9,477 million to 9,487 million in the fourth quarter, according to the latest employment data.

Several industries contributed to this growth, with the trade sector leading the way by adding 24 000 full-time positions. The business services industry followed closely, expanding its workforce by 21 000 jobs. Modest increases were also recorded in the transport and electricity sectors, which added 3 000 and 1 000 jobs, respectively.

Not all industries shared in this growth. The construction sector saw a significant decline, shedding 14 000 full-time jobs. The community services industry followed with a loss of 12 000 jobs, while the manufacturing sector reduced its workforce by 10 000 jobs. Meanwhile, the mining industry reported a decline of 3 000 full-time positions.

Despite the quarterly increases, full-time employment remains lower than it was a year ago. Between December 2023 and December 2024, the number of full-time jobs fell by 26 000.

Part-Time Employment Sees Modest Growth, but Yearly Losses Mount

Part-time employment also experienced a slight uptick, increasing by 2,000 jobs from 1,151 million in September 2024 to 1,153 million in December 2024. This growth was mainly driven by the trade industry, which added 18 000 part-time positions. The business services and construction sectors each contributed an additional 1 000 jobs.

However, other industries struggled to maintain their part-time workforce. The community services sector recorded the largest decline, losing 14 000 jobs. The manufacturing industry shed 3 000 part-time positions, while the transport sector reported a decrease of 1 000 jobs.

Year-on-year, part-time employment experienced a sharp decline, with 65 000 fewer jobs compared to the same period in 2023.

While the latest figures indicate short-term gains in both full-time and part-time employment, the overall labour market continues to face challenges, particularly when compared to the previous year’s performance.

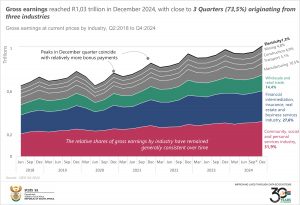

Employee Earnings See Strong Growth, but Overtime and Average Salaries Show Mixed Trends

Total gross earnings paid to employees increased by 6,1%, reaching R1,03 trillion in December 2024 compared to R969,4 billion in September 2024. This growth was primarily driven by higher earnings in key industries, with the trade sector leading the way at R13,6 billion in additional earnings. The manufacturing and community services industries followed closely, adding R13 billion and R12,4 billion respectively. Other notable gains came from the business services (R7,6 billion), construction (R6,4 billion), transport (R4,6 billion), and electricity (R2,5 billion) sectors. However, the mining industry stood as the only sector to report a decline, with gross earnings dropping by R910 million.

Basic Salaries and Wages Continue to Climb

Basic salaries and wages also saw an increase, rising by 0,8% (or R9,5 billion) to a total of R889,7 billion in December 2024. The community services, trade, manufacturing, business services, transport, construction, and electricity industries were the key contributors to this upward trend. However, the mining industry once again diverged from the overall growth, reporting a decline in salaries and wages.

On a year-on-year basis, from December 2023 to December 2024, basic salaries and wages increased by 4,0%, adding R34,1 billion to the economy.

Bonus Payments Surge While Overtime Pay Declines

The biggest quarterly gain came from bonus payments, which rose by R51,8 billion (85,4%), climbing from R60,7 billion in September 2024 to R112,5 billion in December 2024. This sharp rise was largely driven by increased bonus payouts in the manufacturing, trade, community services, business services, construction, transport, and electricity sectors. On a year-on-year basis, bonus payments grew more modestly by 3,2%, adding R3,4 billion compared to December 2023.

Meanwhile, overtime payments declined by 7,7% (R2,2 billion) in the fourth quarter of 2024, reaching R26,4 billion. Despite the overall drop, the manufacturing, trade, and construction industries reported increases in overtime payments. However, on a yearly basis, overtime payments fell by R2 billion, marking a 7,1% decline compared to the previous year.

Average Monthly Earnings Show Diverging Trends Across Industries

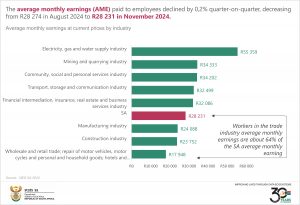

The average monthly earnings (AME) paid to employees saw a slight quarterly decline of 0,2%, dropping from R28 274 in August 2024 to R28 231 in November 2024. However, on a year-on-year basis, average earnings still showed strong growth, increasing by 5,3%.

A closer look at sector-specific earnings highlights notable disparities. The electricity sector stands out with the highest average monthly earnings, significantly surpassing the overall average. The mining and community services industries also report substantial wages, followed by competitive salaries in the transport and business services sectors. In contrast, the manufacturing, construction, and trade industries fall below the total average, reflecting lower wage levels. These differences highlight the varying economic roles and challenges faced by each industry.

While overall earnings are rising, the latest figures highlight a labour market experiencing both growth and disparities, with some sectors thriving while others struggle to keep pace.

For more information on the latest employment trends, download the full report here.