South African Households Spend R3 Trillion Annually

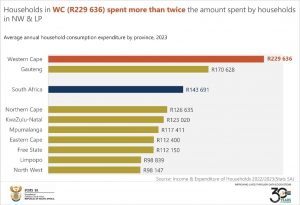

South African households collectively spent an estimated R3 trillion between November 2022 and November 2023, with the average annual household consumption expenditure amounting to approximately R143 691 during the survey year.

These findings are according to the Income & Expenditure Survey (IES) 2022/2023, published by Statistics South Africa (Stats SA). The survey provides valuable insights into household spending patterns, highlighting the financial priorities that shape the country’s household economy.

South African households allocated the majority of their consumption expenditure to four main areas in 2023: housing and utilities, food and non-alcoholic beverages, transport, and insurance and financial services. These categories accounted for 75,6% of total household spending, meaning that three out of every four rand were directed toward these essentials.

While the average annual household consumption expenditure in 2023 was R143 691, the median household consumption expenditure was significantly lower at R82 861. The disparity between the average (mean) and median annual household consumption expenditure in South Africa reflects significant income inequality within the country. A large portion of the population spends well below the national average, pulling the median household consumption expenditure down. The gap between the average and median expenditure is thus a clear indicator of the unequal distribution of resources, with the spending habits of wealthier households skewing the average, while most households operate with much lower expenditure levels.

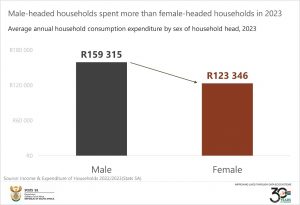

Male-headed households, which contributed just over 60% of total household consumption expenditure, spent an average of R159 315, whereas female-headed households, accounting for slightly less than 40%, spent R123 346 on average.

Income and Provincial Spending Trends

In 2023, the average household income was reported at R204 359. However, male-headed households earned significantly more, with an average annual household income of R239 590, while female-headed households earned an average of R158 481.

Regionally, Gauteng dominated consumption expenditure, contributing 36% of the total household consumption expenditure, followed by the Western Cape at 18,4%. Combined, these two provinces accounted for more than half of all household spending nationwide. While Gauteng’s share was unsurprising due to its population size, Western Cape households emerged as the wealthiest in terms of household consumption expenditure, with an average annual household expenditure of R229 636 and a median consumption expenditure of R128 536. By contrast, Gauteng households spent an average of R170 628 annually, with a median of R96 933.

The Northern Cape recorded the smallest share of total household consumption expenditure at 1,7%, while North West was the poorest province in terms of household spending, with an average annual household consumption expenditure of R98 147 and a median household consumption expenditure of R61 495.

Metro Areas and Urban-Rural Divide

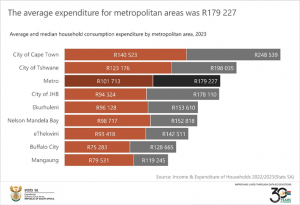

In metropolitan areas, Cape Town households led with the highest average household consumption expenditure of R248 539 and a median of R140 523. The City of Tshwane followed, with an average of R198 035 and a median of R123 176. Mangaung households reported the lowest average metropolitan household consumption expenditure at R119 245.

Urban households were responsible for 81,5% of total household consumption expenditure, far exceeding contributions from traditional (15,3%) and farm areas (3,2%). Households in traditional areas recorded the lowest average household consumption expenditure of R84 502, while farm settlement households had the lowest median consumption expenditure at R59 503.

Racial Disparities in Household Spending

Black African-headed households faced significant financial constraints, with 45,3% in the lowest two expenditure quintiles, spending less than R25 063 annually. Only 13% of black African-headed households were in the highest expenditure quintile. In comparison, 21% of coloured-headed households fell in the upper expenditure quintile, while 34,4% remained below the third expenditure quintile

Indian/Asian and white-headed households were predominantly in higher spending brackets. Nearly 77% of Indian/Asian-headed households were in the upper two expenditure quintiles, while 78,1% of white-headed households fell into the top expenditure quintile.

Shifts in Household Spending Patterns (2015–2023)

Over the last eight years, average household consumption expenditure decreased by 7,2% in real terms. However, black African-headed households bucked the trend, experiencing an 8,8% increase in real household spending. Other population groups – coloured (-0,4%), Indian/Asian (-1,2%), and white-headed households (-20,7%) – saw declines. The decline in household consumption expenditure of white-headed households may be due to under-reporting by sampled households instead of actual changes to household spending patterns.

The IES 2022/2023 offers a detailed picture of household spending patterns and economic inequality in South Africa, reflecting the continuing disparities between province, settlement types, and population groups. These insights provide a valuable basis for addressing economic challenges in South Africa.

The Income & Expenditure Survey (IES) is a household-based survey that collects data on acquisition, spending, consumption, and income earned by households. The survey aims to provide reliable data on measurement of poverty, inequality, income and expenditure patterns, and will inform the updating of the goods and services basket for the Consumer Price Index (CPI). This report focuses on household consumption expenditure across 13 expenditure divisions and income patterns, with the other objectives to be covered in future publications.

For more information, download the IES release, media presentation and Excel files here.