Public-sector capex rises for a second straight year

Infrastructure investment has a long-term impact on the economy, supporting travel, communication, logistics and service provision. The South African public-sector recorded a second consecutive year of capital expenditure growth, boosted mainly by increased spending by public corporations.

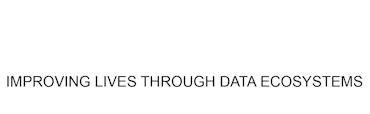

Capital expenditure includes money that is spent on machinery, construction, equipment, buildings, land and other fixed assets. In 2023, South Africa’s 749 public-sector institutions injected R233 billion of capital spending into the economy. This is 10,9% more than the R210 billion recorded in 2022 and represents the second successive increase following a five-year slump (Figure 1).

The post-lockdown spending boom contributed to the rise. Many public-sector institutions experienced backlogs in capital spending during the pandemic. As lockdown conditions eased, institutions accelerated efforts to fulfil their infrastructural commitments.

However, despite the two-year boost, capital expenditure remains below the 2016 peak of R283 billion.

A closer look at the largest contributors

Public corporations were the biggest capital spenders in 2023, followed by local government, provincial government, extra-budgetary accounts and funds (EBAs), national government and higher education institutions. The charts below show trends for each of these groups, sourced from Stats SA’s recent Capital expenditure by the public sector statistical report.

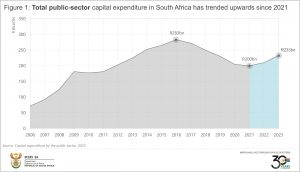

Public Corporations committed R87 billion to capital expenditure in 2023 (Figure 2). This accounted for 38% of total public-sector expenditure that year.

Eskom was the biggest player (R39 billion), with the power utility focussing on the construction of high-voltage transmission lines. The Passenger Rail Agency of South Africa spent R16 billion, mainly on the renewal of rolling stock and the modernisation of its depots. Transnet was the third largest contributor (R15 billion) in this group, followed by Telkom (R6 billion), Rand Water (R2 billion) and uMngeni-uThukela Water (R2 billion).

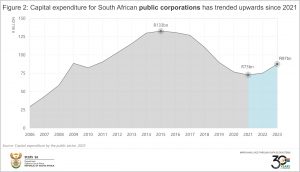

South Africa’s 257 municipalities incurred R62 billion (26% of total public-sector capital expenditure) in 2023 (Figure 3). City of Cape Town accounted for R7 billion, mainly on water and sewerage infrastructure networks. Other large municipalities were also notable contributors, including City of Johannesburg, eThekwini, Ekurhuleni, City of Tshwane, Nelson Mandela Bay and Buffalo City.

In contrast to other institution types, municipalities recorded a decline between 2021 and 2022.

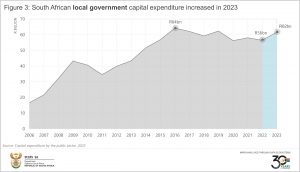

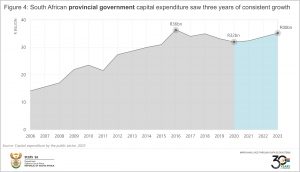

Provincial government departments accounted for R35 billion, or 15% of the total (Figure 4). The Western Cape Department of Transport and Public Works spent R3 billion, mainly on the rehabilitation of roads. The KwaZulu-Natal Department of Transport contributed R3 billion, followed by the KwaZulu-Natal Department of Education (R2 billion) and the Gauteng Department of Health (R2 billion).

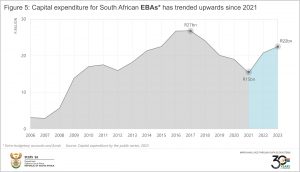

South Africa’s 258 EBAs are public institutions that provide services to the public on behalf of government. Examples include the National Research Foundation, the Unemployment Insurance Fund and the South African Social Security Agency. After declining to a low of R15 billion in 2021, EBA capital expenditure increased to R22 billion in 2023, accounting for 10% of overall public-sector capital expenditure (Figure 5).

The South African National Roads Agency recorded R9 billion, mainly on the development and maintenance of roads in North West, Northern Cape and Eastern Cape. Other EBA heavyweights include the Water Trading Entity (R4 billion) and the Property Management Trading Entity (R2 billion). The South African Revenue Service spent R790 million, focussing on computer equipment, leasehold improvements and water vehicles.

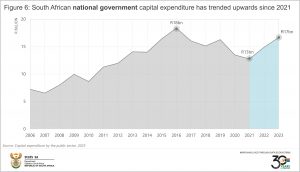

National government departments recorded R17 billion (or 7% of the total) in 2023 (Figure 6). The South African Police Service was the biggest spender (R3 billion), focussing mainly on the construction of police stations. Other notable contributors in 2023 included the Department of Water and Sanitation (R3 billion) and the Department of Defence (R2 billion). The Department of Basic Education (R2 billion) focussed much of its attention on the construction of 27 new schools through the Accelerated School Infrastructure Delivery Initiative.

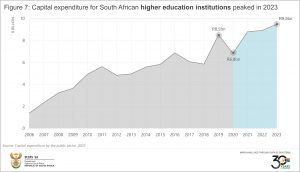

Capital expenditure for higher education institutions reached an all-time high of R9,5 billion in 2023 (Figure 7), representing 4% of total public-sector capital expenditure that year. Stellenbosch University accounted for R870 million, mainly on the construction of a 400-bed residence. The University of Mpumalanga incurred capital expenditure of R723 million, focussing on developing the west and south campuses of the university.

In summary, South African public-sector expenditure expanded for a second consecutive year in 2023. Public institutions, municipalities and provincial government were the biggest spenders.

Government’s Economic Reconstruction and Recovery Plan, which was announced in October 2020, links infrastructure investment and related institutional reforms to support higher economic growth. Increased and effective infrastructure spending is a key element of this plan.1 Government commitment, together with the prospect of an improved economic environment, might bode well for the future of public-sector capital expenditure.

For more information, download the 2023 Capital expenditure by the public sector statistical release and Excel unit data here.

1 National Treasury, 2023. Budget Review. Annexure D: Public-sector infrastructure and Public-Private Partnerships update (download here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.