Economic wrap-up for September 2024

Stats SA published several quarterly and annual reports in September, along with the usual set of monthly indicators.

South African economy expands in the second quarter

The month began with the release of the latest gross domestic product (GDP) figures, covering the second quarter of the year. The economy saw some growth, mainly lifted by a buoyant financial and business services industry. Electricity, gas & water; trade; manufacturing; government; construction; and personal services also recorded positive gains.

There was no load shedding in the second quarter, which contributed positively to the electricity, gas & water supply industry, but also indirectly to the rest of the economy. The electricity, gas & water supply industry witnessed its strongest quarterly growth rate in almost 16 years (barring the volatile economic environment caused by the pandemic in 2020).

On the downside, the mining, agriculture and transport industries disappointed. The transport, storage & communication industry was the biggest drag on overall GDP growth, driven lower by strike action and softer freight volumes in the second quarter.

Other notable Stats SA outputs that were released in September include provincial GDP estimates, formal business sector data (covering finances, employment and capital expenditure), and financial data for local government and provincial government.

Inflation continues to soften

Consumer inflation cooled to 4,4% in August, dipping below the 4,5% mid-point of the South African Reserve Bank’s inflation target band. The inflation print in August is the lowest in over three years. Softer inflation was recorded for key product groups, including transport, housing, and restaurants & hotels. Fuel prices dipped further in the month, recording a third consecutive decline. Inflation at the factory gate also softened, easing to 2,8% in August.

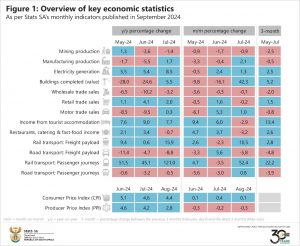

Several sectors in the South African economy enjoyed a positive July, according to the latest business cycle indicators. Manufacturing, electricity generation, construction (buildings completed as reported by large municipalities), motor trade and rail transport recorded positive year-on-year and month-on-month growth rates (Figure 1).

Mining; wholesale trade; restaurants, catering & fast-food; and road transport (freight) witnessed a lacklustre July in both year-on-year and month-on-month terms. Wholesale trade registered a third consecutive month of decline.

What to look forward to in October

The public sector will be in the spotlight in October, with two annual reports due for release. The first will cover capital expenditure data for the public sector. The second will provide a financial overview of higher education institutions. Both will be published on the last day of the month.

Interested to know more? Keep up to date with our publication schedule here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of indicators and infographics, visit our data story feed and download the latest edition of the Stats Biz newsletter.