Economic wrap-up for August 2024

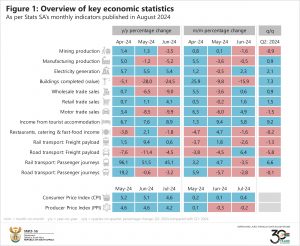

The latest set of economic indicators paint a preliminary picture of economic performance in the second quarter (April–June).

The quarter in a nutshell

Several sectors enjoyed positive gains in the second quarter of 2024 compared with the first quarter of 2024. These include manufacturing, electricity generation, construction (buildings reported as completed to larger municipalities), wholesale trade, retail trade, tourist accommodation, and rail passenger transport (Figure 1).

The retail trade sector was particularly upbeat. Sales increased by 1,5%, representing the largest rise since the first quarter of 2022 (1,9%). All retail groups recorded positive growth, with textiles & clothing and general dealers driving much of the upward momentum.

Manufacturing production crept higher by 0,9%, helped mainly by the automotive and food & beverages divisions.

Sectors that witnessed a weaker quarter include mining; motor trade; restaurants, catering & fast-food; freight transport (rail and road); and road passenger transport. Mining production slipped by 0,9%, with downward pressure from iron ore, coal, diamonds and gold. The industry produced more platinum group metals, chromium ore, nickel, manganese ore and copper, but this was not enough to lift the industry into positive territory.

The motor trade sector was also lacklustre, dragged lower by a decline in sales of fuel, accessories, new vehicles, and merchandise from convenience stores. However, workshop income and sales of used vehicles were positive.

These figures are a prelude to the next gross domestic product (GDP) release, which will cover the second quarter in more detail. Stats SA will publish the GDP figures on 3 September 2024 at 11:30. So watch this space!

Jobless rate at a two-year high

The official unemployment rate climbed to 33,5% in the second quarter, the highest since the second quarter of 2022 when it was 33,9%. The labour market shed an estimated 92 000 jobs, while the number of unemployed increased by 158 000.

The industries that recorded job losses include trade, agriculture, private households, construction and finance. Manufacturing, community & social services, utilities, transport and mining witnessed a rise in the number of employees.

Inflation on a downward trend

The month saw positive news on the inflation front. Consumer price inflation sunk to a three-year low of 4,6% in July from 5,1% in June. Lower rates were recorded for a number of product categories, most notably food & non-alcoholic beverages, transport and housing & utilities.

Producer price inflation was also lower, easing to 4,2% in July from 4,6% in June. The rate in July is the lowest since December 2023 (4,0%).

What to look forward to in September

As mentioned above, the next set of national GDP figures will be published tomorrow. Another key highlight to look out for in the month will be the release of the latest regional GDP figures. These data, which will be published on 19 September, will provide insight into the state of provincial economies.

Interested to know more? Keep up to date with our publication schedule here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of indicators and infographics, visit our data story feed and download the latest edition of the Stats Biz newsletter.