Economic wrap-up for June 2024

June was a bumper month for statistical reports. Stats SA published 40 releases in the month, providing monthly, quarterly and annual economic updates. Here are a few highlights.

The South African economy weakens in the first quarter

The month began with the release of the latest gross domestic product (GDP) figures. The economy contracted by 0,1% in the first quarter of 2024, dragged lower by manufacturing, mining and construction. A weaker automotive sector was the main reason behind manufacturing’s poor showing, while mining was pulled lower by the platinum group metals, coal, gold and manganese ore. Other industries that performed poorly on the supply side of the economy include transport, storage & communication; electricity, gas & water; and general government services.

Not all was bad news, however. Agricultural activity rose sharply on the back of stronger horticultural production. Trade catering & accommodation; personal services; and finance, real estate & business services made much smaller gains.

The demand side of the economy was also lacklustre. Imports, exports, gross fixed capital formation, household consumption and government consumption all decreased in the first quarter.

Formal sector jobs decline

According to the latest Quarterly Employment Statistic (QES) release, the first quarter also witnessed softer employment numbers in the formal non-agricultural sector. The net loss of 67 000 jobs was mainly concentrated in the trade and community services industries, with smaller declines recorded in business services and mining. On a positive note, employment increases were recorded in manufacturing, transport and construction.

The formal non-agricultural sector reported a 5,5% decrease in total turnover in the first quarter. Seven of the eight industries in the Quarterly Financial Statistic (QFS) report recorded declines. Mining recorded the largest percentage decrease. Community, social & personal services (excluding government and educational institutions) kept its head above water, increasing turnover by 3,3%.

The second quarter is off to a relatively positive start

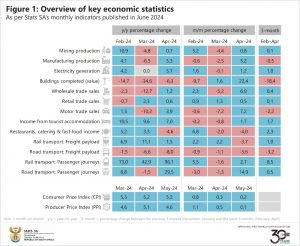

The latest set of business cycle indicators cover April, the first month of the second quarter. Several sectors recorded both positive year-on-year and month-on-month gains. These include mining, manufacturing, electricity generation, wholesale trade, retail trade, motor trade, tourist accommodation and passenger transport (Figure 1).

On the downside, food & beverages income (restaurants, catering & fast food) decreased by 4,6% year-on-year and by 4,0% month-on-month in April. The volume of goods (freight payload) transported on South African roads continued a downward trajectory, recording negative year-on-year and month-on-month growth rates.

National government spending breaks the R2 trillion mark

Stats SA is responsible for publishing several annual reports on government finances, which includes national, provincial and local government, as well as extra-budgetary accounts & funds and higher education institutions.

According to the Financial statistics of national government statistical report, released in June, government spending topped R2,0 trillion in 2022/23. Financial transfers to other levels of government, institutions and foreign governments accounted for just over half of the R2,0 trillion, followed by interest paid on debt and social benefits. National government generated or received R1,7 trillion in revenue, with taxes accounting for 97%.

Want to find out more on what Stats SA has to offer? Our publication schedule is available here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of indicators and infographics, visit our data story feed here and catch the latest edition of the Stats Biz newsletter here.