Economic wrap-up for May 2024

Stats SA published 24 releases in May, with many providing a preliminary overview of economic performance in the first quarter (January–March).

Key industries down in the first three months of the year

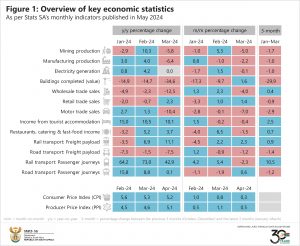

Mining, manufacturing, electricity, construction, retail trade, motor trade and road transport were weaker in the first quarter of 2024 compared with the fourth quarter of 2023 (Figure 1). Construction (buildings completed as reported by large municipalities) witnessed a notable decline of 29,9%, mainly due to a decrease in the completion of non-residential and residential buildings.

Mining production decreased by 1,7% in the first quarter, led by declines in platinum group metals, coal and gold. Despite the overall negative growth, iron ore production was stronger and emerged as the largest positive contributor.

The manufacturing industry also faced headwinds, recording a decline of 1,0%. Five of the ten manufacturing divisions reported negative growth rates, with the automotive division the most significant drag on growth. Much of the weakness in the automotive division originated from the production of parts and accessories.

The metals and machinery division remained on the back foot, recording a third consecutive quarter of decline.

Motor trade contracted by 2,9%. Cash-strapped consumers held back from purchasing new and used vehicles. Workshop income, sales of accessories and convenience store sales were also down. The only bright spot in the motor trade sector was fuel sales, which increased in the first quarter.

South African retail trade was 0,9% softer, with three of seven retail groups reporting negative growth rates. The textiles and clothing retail group was the biggest drag on overall performance, marking its second consecutive quarter of decline. Hardware, paint and glass also performed poorly. On the positive side, general dealers – as well as retailers in food & beverages, household appliances and pharmaceuticals & cosmetics – registered better results.

Not all was bad news in the first quarter. Wholesale trade, tourist accommodation, restaurants, catering & fast food, and rail transport recorded positive growth. Income from tourist accommodation increased by 2,5%, with positive results from guest houses & guest farms, caravan parks & camping sites, and the miscellaneous group ‘other’ accommodation. Hotels, however, generated less income in the first quarter.

Unemployment rate the highest in a year

The official unemployment rate edged higher to 32,9% in the first quarter of 2024, up from 32,1% in the previous quarter. This represents the highest reading since the beginning of 2023 when the rate was also 32,9%. The number of those employed increased by an estimated 22 000 in the first quarter, but this was not enough to offset the rise in the number of the unemployed, which rose by 330 000 individuals. Employment gains were mainly recorded in the trade, manufacturing, private households and transport industries, while declines were recorded in community & social services, construction, finance and utilities.

Inflation a mixed bag

Consumer inflation recorded a second consecutive month of decline in April, moderating to 5,2% from 5,3% in March and 5,6% in February.

However, on the producer side, annual inflation at the factory gate increased for a second consecutive month, rising to 5,1% from 4,6% in March and 4,5% in February. Petroleum & chemicals, food & beverages and metals & machinery drove much of the upward inflationary pressure in April.

The latest GDP results to be released tomorrow

A much more comprehensive overview of how the economy performed in the first quarter will be revealed in the next gross domestic product (GDP) release on Tuesday, 4 June at 11h30. The release will be published here, so watch this space!

Want to find out more on what Stats SA has to offer? Our publication schedule is available here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of indicators and infographics, visit our data story feed here and catch the latest edition of the Stats Biz newsletter here.