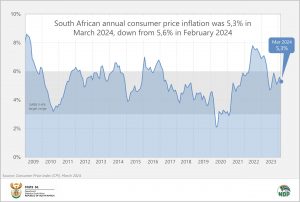

Consumer inflation cooled in March

Following a two-month upswing, headline inflation softened to 5,3% in March from 5,6% in February. The rate has held its ground between 5% and 6% since September 2023.

The monthly change in the consumer price index (CPI) was 0,8% in March. This is lower than the 1,0% increase in February.

The biggest movers in March

The categories with the highest annual price changes in March were miscellaneous goods & services (up 8,5%), education (up 6,3%), health (up 6,0%) and housing & utilities (up 5,9%).

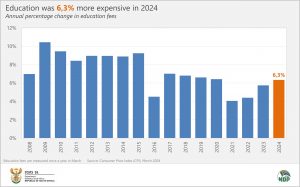

Education fees are surveyed once a year in March.1 Overall, education was 6,3% more expensive in 2024 than it was in 2023. This exceeds the 5,7% annual increase in 2023 and is the highest since 2020 when the rate was 6,4%.

High schools recorded the most significant increase in 2024 (up 7,3%), followed by primary schools and tertiary institutions (both up by 5,9%).

Crèches and university boarding were also surveyed in March. Crèches increased their fees by 6,0%. University boarding is on average 8,2% more expensive than a year ago.2

The increase in miscellaneous goods & services was mainly driven by higher health insurance premiums, recorded by Stats SA in February. As reported in last month’s review,3 the average price of health insurance increased by 12,9% in 2024.

The 6,0% annual rise in the health index was driven by increased prices of medical products and medical services.

Food inflation at a three-and-a-half-year low

Inflation for food and non-alcoholic beverages (NAB) slowed to 5,1% in March from 6,1% in February. This is down from its recent peak of 14,0% in March 2023, and is the lowest annual increase since September 2020 when the rate was 3,8%.

Bread & cereals registered a softer annual print of 5,0% from February’s 6,1%. The rate is substantially lower than the recent high of 21,8% in January 2023. Bread flour, pasta, rusks, maize meal, ready-mix flour and white bread are cheaper than a year ago.

Meat inflation also cooled in March on the back of lower beef and mutton prices. The annual rate for meat in March was 0,8%, significantly lower than the recent peak of 11,4% in February 2023.

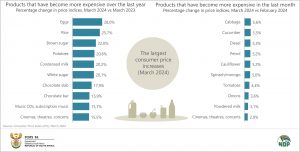

Annual inflation for sugar, sweets & desserts has remained above the 15,0% level since June 2023. The rate in March 2024 was 17,8%. Products with the most significant annual price increases include brown sugar (up 22,0%), white sugar (up 20,1%), chocolate slabs (up 17,9%) and chocolate bars (up 15,9%).

Other notable prices changes in March

Inflation for alcohol & tobacco was fuelled by annual increases in excise taxes. The index increased by a monthly 1,9% in March. This is the highest monthly rise since March last year, when excise tax increases led to a 2,2% monthly rise. Prices increased by 4,5% overall in the 12 months to March.

Housing rents were surveyed in March, rising by 0,8%.

The transport index rose by 2,0% between February and March, mainly due to a monthly rise of 5,3% in fuel prices. On average, petrol increased by 5,2% and diesel by 5,3%.

The graphs below show the products that recorded the most significant annual and monthly price increases in March.

Download the March 2024 CPI statistical release and Excel files with indices and average prices here. The archive is available here.

1 Prices for several items in the inflation basket are not surveyed monthly. See Table F in the statistical release for the complete survey schedule.

2 In the CPI basket, primary schools, high schools and tertiary institutions are classified in the education category. Crèches are classified under miscellaneous goods & services and university boarding under restaurants & hotels.

3 Stats SA, Inflation heats up for a second consecutive month (read here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.