Economic wrap-up for November 2023

Stats SA published 25 statistical releases in November. Here is a quick overview of the latest economic indicators.

Employment surpasses pre-COVID-19 levels

Covering a sample of about 30 000 households across the country, the Quarterly Labour Force Survey reported a rise in employment figures in the South African workforce. The economy created 399 000 jobs in the third quarter, lifting the total number of employed persons to 16,7 million. This is the first time that the number of employed has surpassed the pre-COVID level of 16,4 million.

The official unemployment rate declined to 31,9% in the third quarter. Although this is the lowest reading in three years, the sobering fact is that South Africa continues to struggle with one of the highest unemployment rates in the world.

Agriculture employment also up

Commercial agriculture also posted positive employment gains, according to an annual survey covering the industry. There were 30 773 new jobs in 2022, expanding the formal agriculture labour force to 814 518 individuals from 783 745 individuals in 2021.

The survey also highlighted the products keeping the industry afloat. Fruit, maize and cattle were the biggest generators of income in 2022. Sales of fruit (including grapes) accounted for R62 billion, or 16% of total sales in the agriculture industry, followed by maize (R57 billion or 14%) and cattle (R54 billion or 13%).

Consumer prices bite as inflation rises once again

Fruit products were on average 8,5% more expensive in October compared with the same month the previous year, according to the latest consumer inflation data. Bananas registered a price increase of 33% over this period.

Consumers also felt the pain with other food products such as potatoes (up 64,6%), pumpkin (up 36,1%) and cauliflower (up 31,4%). Eggs were on average 24,4% more expensive in the twelve months to October, with prices mainly driven higher by the recent outbreak of avian flu.

Food and non-alcoholic beverages, housing & utilities and transport contributed to the headline inflation rate in October, which was 5,9%.

The producer price index (PPI), a leading indicator of consumer inflation, increased for a third consecutive month, rising to 5,8% in October.

Economic indicators for the third quarter

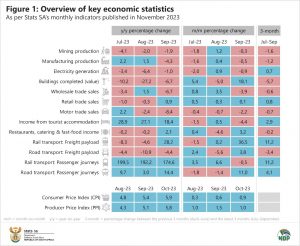

The latest set of business cycle indicators concludes the results for the third quarter (July–September) of 2023. The mining, manufacturing, construction (buildings completed), wholesale trade, motor trade and the restaurant, catering & fast-food industries reported weaker results in the third quarter compared with the second quarter (Figure 1). Road freight activity was also down.

On the upside, electricity generation, retail trade, tourist accommodation, rail freight transport and passenger transport (both road and rail) increased in the third quarter.

What to look forward to in December

A much more comprehensive overview of how the economy performed in the third quarter will be revealed in the next gross domestic product (GDP) release on Tuesday, 5 December at 11h30. The release will be published here, so watch this space!

Other key releases to look out for in December include a quarterly financial report for local government, as well as a quarterly financial report and employment figures for the formal business sector.

Interested to know more? Stats SA’s publication schedule is available here. For a comprehensive list of products and releases, download our catalogue here. For a regular update of economic indicators and infographics, visit our data story feed and catch the latest edition of the Stats Biz newsletter.