Electricity: a vital resource for municipalities

Municipalities generate most of their revenue from electricity sales. Those involved in providing services buy electricity from producers (such as Eskom) and then resell the power to households, businesses and other institutions. The resulting surplus from this trade is a vital source of income.

Electricity’s contribution to revenue

Municipalities spent R50,2 billion on electricity purchases in the first six months of 2023.1 In turn, they generated R60,0 billion from electricity sales. The R9,8 billion difference between the two represents a surplus that municipalities can use to cover other expenses.

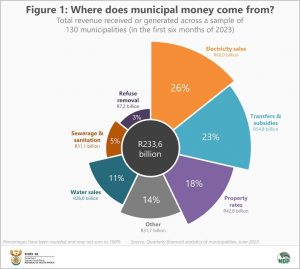

Electricity sales take up a significant slice of the revenue pie. In fact, it’s usually the biggest revenue stream. In the first six months of the year, sales of electricity accounted for just over a quarter of total municipal revenue. Sales of electricity was followed by funding from government (in the form of transfers and subsidies) and property rates (Figure 1).

Breakdown of revenue streams

These revenue streams can be grouped into two broad categories: internally generated revenue and financial transfers from government. Internally generated revenue is money that municipalities generate themselves. These include service charges (such as sales of electricity, sales of water, refuse removal, and sewerage & sanitation) and property rates.

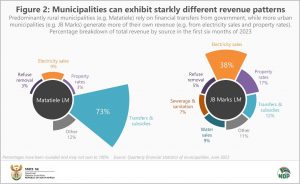

Cities and large towns are able to supplement their budgets with internally generated revenue, while rural areas depend more on money from government.

Figure 2 shows the revenue streams for two local municipalities. Matatiele, located in Eastern Cape, is mostly rural. It sources the bulk of its revenue from government transfers and subsidies. JB Marks in the North West province, which includes the towns of Ventersdorp and Potchefstroom, is more urban, generating much of its revenue from electricity sales and property rates.

Electricity trade eased in the first half of 2023

Has load shedding had an impact on electricity sales? According to The Outlier, there were 62 days of loadshedding in the first half of 2022.2 This expanded to 180 days in the first half of 2023. In other words, there was only one day without loadshedding in the first six months of 2023. For those who are interested, that was 21 March.

It’s difficult to tease out the exact impact of load shedding on municipal purchases and sales as the data are influenced by several factors. It is notable, however, that both municipal purchases and sales of electricity softened in the first six months of 2023. Municipal purchases of electricity decreased by 0,8% compared with the first six months of 2022. This is the first time since 2018 that a decline was recorded in the first half of the year. Municipal sales of electricity increased by 0,6%, the slowest rise since 2018.

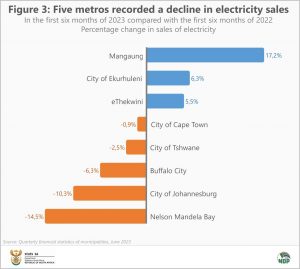

The eight metropolitan municipalities account for the bulk of total electricity sales across local government. In the first six months of 2023, five of the eight metropolitan municipalities recorded a decline in sales compared with the same period in 2022 (Figure 3). Mangaung, the City of Ekurhuleni and eThekwini registered increases.

As a collective, metropolitan municipalities recorded a decline (of 0,8%) in sales of electricity.

1 The data in this article are from Stats SA’s Quarterly financial statistics of selected municipalities survey. The survey collects financial information from the largest 130 municipalities. Download the latest set of results here.

2 The Outlier & EskomSePush (access the data here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.