Recent shifts in company income tax

Although the mining industry strengthened company tax collections after the COVID-19 pandemic, its momentum has recently waned.

The importance of CIT

Company income tax (CIT) was the third largest source of government tax revenue in 2021/22, according to the South African Revenue Service (SARS).1 Personal income tax was the largest contributor (35,5%), followed by value-added tax (25,0%), CIT (20,7%) and other levies and taxes (18,8%).

As SARS points out, although CIT has retained its position as the third largest source of tax revenue, its contribution has weakened over the years. In 2008/09, CIT’s contribution was 26,7%. This slowly declined to 15,9% in 2019/20.

After the pandemic, however, CIT surprised on the upside. Its contribution increased to 20,7% in 2021/22. CIT also rose in absolute terms, from a pre-pandemic R214 billion in 2018/19 to R323 billion in 2021/22. According to SARS, this was mainly due to stronger growth in the mining (supported by commodity price increases), manufacturing and financial sectors.

2020 and 2021

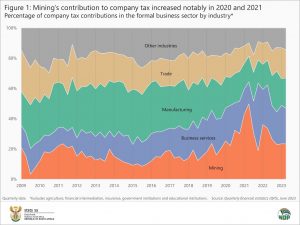

The rise in CIT in 2021/22 corresponds with data from Stats SA. The Quarterly financial statistics (QFS) survey collects financial data from enterprises in the formal business sector.2 It shows that the business services, manufacturing, mining and trade industries are the largest contributors to company tax.

Plotting these contributions over time shows the impact that mining had on tax collection in 2020 and 2021 (Figure 1). Mining accounted for 25% of total company tax in Q1: 2020, just before the pandemic. Its contribution increased to a high of 50% in Q2: 2021.

The industry recorded the largest increase in taxes paid, from R8 billion in Q1: 2020 to R31 billion in Q2: 2021 (up 277%). Stronger mineral sales were recorded too – according to data from Stats SA’s Mining: Production and sales statistical release – with sales of platinum group metals driving much of the upward momentum.3

Most of the industries covered in the QFS survey registered a rise in company tax over this period. Mining was followed by construction (up 60%), manufacturing (up 59%), and business services (up 28%). Electricity, gas & water, transport, storage & communication and trade also recorded increases. As a result, total company tax – as reported by the QFS survey – increased from R32 billion in Q1: 2020 to R62 billion in Q2: 2021. Mining was the largest positive contributor.

The personal services industry was the lone exception, recording a decline of 12%.

2021 to present

After its peak in Q2: 2021, CIT from the mining industry lost ground, shrinking from R31 billion to R12 billion in Q2: 2023. The industry’s contribution weakened too, from 50% to 23%.

Overall company tax continued to rise, from R62 billion in Q2: 2021 to a high of R77 billion later that year. It then declined to R49 billion in Q2: 2023. Despite the decline, total company tax is still above the R32 billion mark recorded in Q1: 2020.

Manufacturing’s long-term decline

Mining may have its moments when commodity cycles peak. Manufacturing, on the other hand, exhibits a different pattern in Figure 1. The industry’s contribution to total CIT has slowly eroded. After reaching a peak of 37% in Q1: 2015, manufacturing’s contribution weakened, reaching an average of 17% in 2021. In Q2: 2023, its contribution was 20%.

For more information on company tax and other financial indicators, download the latest Quarterly financial statistics (QFS) statistical release here.

1 SARS, Tax Statistics, 2022 (download here).

2 In the QFS, the formal business sector includes private businesses and public corporations, but excludes agriculture, financial intermediation, insurance, government institutions and educational institutions.

3 Stats SA, Mining: Production and sales, July 2023. ‘Mining Production and sales (202307)’ Excel file (download here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.