Economic wrap-up for June 2023

Stats SA published 26 statistical releases in June, shedding light on the current state of the economy.

SA narrowly averts recession

The month began with the release of the latest gross domestic product (GDP) figures. After faltering in the fourth quarter of 2022, the South African economy expanded by 0,4% in the first quarter of 2023, narrowly avoiding a recession.1

Eight of the ten industries grew in the first quarter, with manufacturing and finance, real estate & business services driving much of the momentum. On the downside, agriculture decreased sharply. The electricity, gas & water industry continued to struggle with its fourth consecutive quarter of decline.

The demand side of the economy registered a rise in exports, backed up by increased investment and positive government and household spending.

Despite the positive GDP reading, the level of economic activity is still 0,7% down from the recent peak reached in the third quarter of 2022.

Turnover and employment down in the formal business sector

The formal non-agricultural business sector recorded a lacklustre first quarter. Turnover declined by 3,2%, with the largest decreases recorded in manufacturing and trade. Personal services and business services kept their heads above water, recording a rise in turnover over the same period.

On employment, the sector registered an overall loss of 21 000 jobs in the first quarter, dragging the level of formal employment down to 9,97 million individuals. The trade industry recorded the largest number of job losses, followed by business services, construction and transport. On the positive side, community services, mining, manufacturing, and electricity, gas & water registered a rise in employment.2

Manufacturing: be mindful of the base effect

After five consecutive months of year-on-year decline, South African manufacturing turned positive in April, growing by 3,4%. The sharp increase was mainly due to the base effect with an unusually low level of production recorded in April 2022 (caused by the devastating floods in KwaZulu-Natal).

The 3,4% rise was mainly fuelled by metals & machinery and food & beverages. Most other divisions recorded positive growth too, with the exception of wood, paper, printing & publishing and glass & non-metallic mineral products.

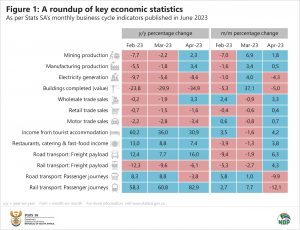

Figure 1 provides a summary of the latest business cycle indicators.

Inflation continues to cool

Now for some good news. Consumer inflation slowed further in May, decreasing to 6,3% from 6,8% in April. This is the lowest reading in 13 months, with food and transport inflation continuing to ease. Producer inflation was also softer in May, declining to 7,3% from 8,6% in April. This represents the tenth consecutive month of decline for price inflation at the factory gate.

Government enjoys a rise in tax revenue

National government recorded a sharp increase in collected taxes in 2021/22 compared with 2020/21. Taxes received expanded by 25,1%, from R1,25 trillion to R1,56 trillion. This was mainly underpinned by a rise in company income tax, followed by an increase in personal income tax.

What to look forward to in July

Stats SA will release two detailed reports on the manufacturing industry on Monday, 24 July 2023. These will include a wealth of data on finances, production and employment for the year 2021. The production report will be published here and the financial report will be published here.

To keep up to date with other upcoming releases, see our publication schedule. For a comprehensive list of products and releases from Stats SA, download our catalogue.

1 A recession is defined as two (or more) consecutive quarters of negative growth (real seasonally adjusted quarter-on-quarter GDP).

2 The financial and employment data are sourced from two different statistical releases: the Quarterly financial statistics (QFS) and Quarterly employment statistics (QES). Although these two surveys cover the formal business sector, the two have slightly different scopes.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.

Similar articles are available on the Stats SA website and can be accessed here.