National government financial transfers: Who benefits the most?

One of the important tasks of national government is to redistribute funds, mainly received from taxes, to other sectors of the economy. These transfers serve a financial lifeline to diverse groups which includes households, public corporations, local and international organisations, and other levels of government.

Key areas of spending

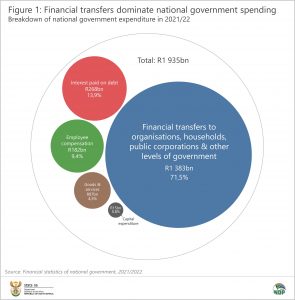

On the revenue side, national government generated R1 605 billion in the 2021/22 fiscal year (1 April 2021 to 31 March 2022). The bulk (97,4%) of revenue was from taxes. On the expenditure side, national government spent R1 935 billion over the same period, according to the latest Financial statistics of national government statistical release.1

Almost R72 of every R100 of national government spending was in the form of financial transfers to households, public corporations, organisations and other levels of government (Figure 1).2

Who are the main beneficiaries?

Financial transfers (which include grants, subsidies and other transfers) keeps the engine of government going. They also provide support for households and assist in funding operating costs of public corporations.

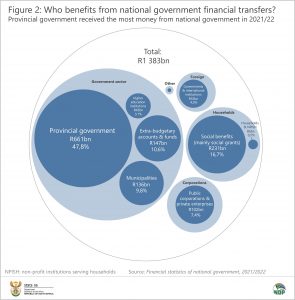

When we break down the blue bubble in Figure 1, data show provincial government as the main beneficiary, receiving nearly half of financial transfers in 2021/22 (Figure 2). This is not surprising, given that provincial government is primarily responsible for administrating the country’s massive public education and healthcare systems.

Provinces that received the most were Gauteng (R141 billion) and KwaZulu-Natal (R135 billion).

Extra-budgetary accounts & funds – public entities that are involved in delivering services to government or to the public on behalf of government – were allocated R147 billion. National Student Financial Aid Scheme (NSFAS) is at the top of the list, with R40 billion received from national government in 2021/22. South African National Roads Agency Limited (SANRAL) was next in line, receiving R22 billion.

Higher education institutions received R43 billion in total, with the largest amounts allocated to the University of South Africa (R5 billion) and University of Pretoria (R3 billion).

Households were the second biggest beneficiary of national government transfers, with social benefits accounting for R231 billion. Social benefits mainly include social grants (e.g. family and children, sickness and disability, and old age).

Public corporations and private enterprises accounted for R102 billion. The following State-Owned Enterprises (SOE) received equity injections to settle government guaranteed debt: ESKOM (R32 billion), South African Airways (R4 billion) and Denel (R3 billion).3 South African Special Risk Insurance Association (SASRIA) received R22 billion to cover claims arising from the civil unrest that crippled parts of Gauteng and KwaZulu-Natal in July 2021.4

Foreign governments and international institutions benefited too, receiving R55 billion in 2021/22. Southern Africa Customs Union (SACU) was the biggest beneficiary, receiving the bulk (R45 billion) of this allocation. This organisation promotes free trade and economic development across the southern African region. As members, South Africa, Botswana, Lesotho, Namibia and Eswatini contribute financially to the union.5

For more information, download the latest Financial statistics of national government statistical release here.

1 Note that the Financial statistics of national government statistical release and all data covered in this article are for national government departments only. Releases for other levels of government (i.e. provincial, local, extra-budgetary accounts) and higher education institutions will be published later in the year. A consolidated document will be published in November, providing a financial overview of the entire government sector for the 2021/22 fiscal year. So watch this space!

2 Total transfers is derived from the sum of the following line items in Table A of the statistical release: subsidies, grants, social benefits (mainly comprised of social grants paid to households) and ‘other’ payments (mainly comprised of transfers to public corporations and private enterprises, households, and non-profit institutions serving households).

3 Department of Public Enterprises, Annual Report 2021/22 (download here).

4 National Treasury, Annual Report 2021/22 (download here).

5 For more information on the SACU, take a read of a 2020 article here.