The South African tourism sector struggled in 2020

Even though 2020 seems like a lifetime ago, the true extent of the COVID-19 pandemic’s impact is still being pieced together. The recent Tourism Satellite Account (TSA) for South Africa report1 sheds light on how the pandemic affected the tourism sector over the period January 2020 to December 2020, most notably in terms of production, expenditure and employment.

Tourism spend tumbled in 2020

South African tourism was hit hard during the first year of the pandemic, according to the most recent data. The COVID-19 lockdown and subsequent travel restrictions severely limited the number of non-resident visitors2 gracing our shores. Non-resident visitors entering through ports of entry slumped from 14,8 million in 2019 to 3,9 million in 2020.

The downturn in non-resident visitor numbers had a ripple effect across the tourism sector. The immediate impact was less inbound tourism expenditure – the much needed foreign currency that non-resident visitors spend during their stay. Inbound tourism expenditure declined by 70,5% in 2020 compared with 2019. Domestic tourism expenditure also decreased in 2020, with resident visitors spending 32,8% less than they did in 2019.

Internal tourism expenditure (inbound and domestic expenditure grouped together), decreased from R455,8 billion in 2019 to R260,4 billion in 2020. The tourism sector therefore lost R195,4 billion in tourism spend in 2020. Internal tourism expenditure was down across all tourism product groups, with tourism non-specific products3 the largest contributor to the decline. This was followed by air passenger transportation services and food & beverages servicing services (Figure 1).

Accommodation, a tourism specific industry that relies heavily on tourism, recorded an internal tourism expenditure decline of R17,0 billion.

Tourism’s direct contribution to the GDP declined in 2020

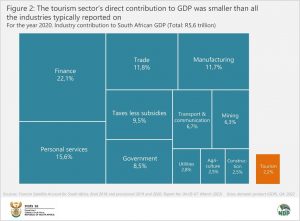

The tourism sector directly contributed 3,7% to GDP in 2019, making it larger than agriculture, construction, and utilities (electricity, gas & water). In 2020, the tourism sector’s direct contribution declined to 2,2%. Against the backdrop of the pandemic, which saw economic activity plummet in most parts of the economy, tourism lost ground against even the smallest industries (Figure 2).

The tourism sector shed direct jobs in 2020

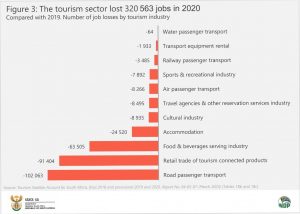

As tourism expenditure declined and economic activity stalled, the number of direct tourism jobs also decreased. The tourism sector lost just over 320 000 jobs in 2020, shrinking from a workforce of 780 096 in 2019 to 459 533 in 2020. Job cuts occurred across the sector, with the biggest losses recorded in activities related to road passenger transport, retail trade of tourism-connected products, and the food & beverages serving industry (Figure 3).

The light at the end of the tunnel

The above is indeed sobering news, but much has happened since 2020. The next TSA report, which will cover the year 2021, is due for release in 2023. It will show to what extent (if at all) the tourism sector recovered from the headwinds of 2020. There is a sign of optimism, though, from data published by Stats SA. Although the number of non-resident visitors to South Africa decreased further in 20214, monthly tourism figures show a notable increase in non-resident visitor arrivals in 2022.5 If sustained, this positive momentum bodes well for the tourism sector in a post-pandemic era.

1 The Tourism Satellite Account (TSA) for South Africa report, released annually, draws from a range of data sources, from national accounts to surveys of international and domestic visitors, visitor arrival statistics, tourist accommodation data, and figures from the restaurant, fast-food and catering industry. Together, these provide insight into the role that tourism plays in the South African economy. For more information, download the Tourism Satellite Account for South Africa report here.

2 A visitor is a traveller who takes a trip to a place outside their usual environment, for less than a year, for any purpose other than to be employed at the place visited. A visitor can either be a same-day visitor, who visits a place for less than one night, or a tourist, whose trip includes an overnight stay.

3 The non-specific products category includes a wide range of products that visitors buy that are not specifically related to tourism-characteristic activities. Most of these products are purchased in the retail (‘shopping’) space.

4 Stats SA, Tourism, 2021. Appendix X (download the report here).

5 Stats SA, Tourism and migration (download the monthly releases for 2022 here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.