Business turnover and expenditure decline for the first time in a decade

Marked by COVID-19, the 2020–2021 period was incredibly challenging for the South African economy. Data from Stats SA’s latest Annual financial statistics (AFS) survey, which includes the first three months of the hard lockdown, shows a decline in formal business turnover and expenditure.

The AFS reference period typically entails a lag effect: the survey reference period for 2021 covers the financial years of companies1 ending on any date between 1 July 2020 and 30 June 2021. During the AFS 2020 reference period, 14% of enterprises that responded to the survey had financial years ending during the first national COVID-19 lockdown. For the AFS 2021 survey, this proportion increased to 88%.

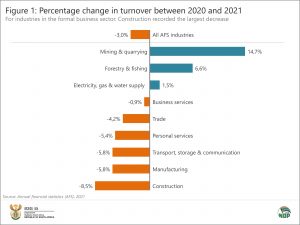

Six industries record a decline in turnover

Formal business turnover declined from R11,0 trillion in 2020 to R10,6 trillion in 2021, representing a decrease of 3,0%. This is the first decline in turnover since AFS 2010, when the global economy was struggling with the fallout from the global financial crisis of 2008/2009 (once again note the AFS reference period lag effect at work).

Six of the nine industries covered by the survey recorded a decrease in 2021 (Figure 1), with construction registering the largest percentage decline (-8,5%).

On the upside, mining & quarrying, forestry & fishing and electricity, gas & water supply registered increases. Buoyant product sales were the main factor behind the increases in turnover in mining & quarrying and forestry & fishing. The rise in turnover reported in the electricity, gas & water supply industry was due to increases in tariffs on goods sold.

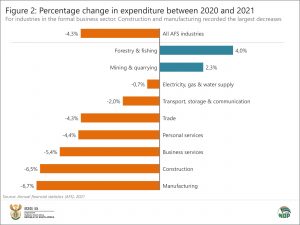

Expenditure declines in line with revenue

Mirroring revenue, expenditure also decreased for the first time since AFS 2010, declining by 4,3%, from R11,2 trillion in 2020 to R10,7 trillion in 2021.

Seven of the nine industries covered by the survey recorded decreases, with manufacturing and construction recording the largest percentage declines (Figure 2). The two industries that registered a rise in expenditure were forestry & fishing and mining & quarrying.

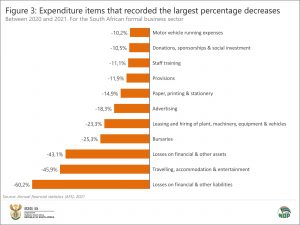

If we consider all AFS industries, the expenditure items that recorded the largest percentage decreases (Figure 3) were losses on financial and other liabilities: redemption, liquidation and revaluation of liabilities; travelling, accommodation and entertainment; losses on financial and other assets: disposal of assets, realisation for cash and revaluation of assets; and bursaries.

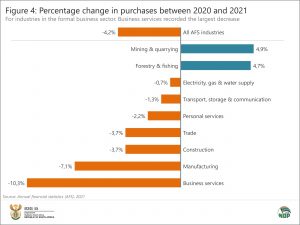

Purchases, which is the largest component of expenditure, reported a decline of 4,2% between 2020 and 2021, from R6,7 trillion to R6,4 trillion. The industry that reported the largest percentage decrease in purchases was business services2, followed by manufacturing, construction and trade (Figure 4). Increases were reported in mining & quarrying and forestry & fishing.

For more information, download the AFS 2021 statistical release and associated Excel files here.

1 The AFS survey measures the financial health and performance of each industry, providing information on turnover, purchases, and capital expenditure. The report sources data from the financial statements of enterprises (i.e. private businesses and public corporations), and is in turn an important source for estimating annual gross domestic product (GDP). The AFS excludes agriculture and hunting; general government and educational institutions; and financial intermediation, pension funding, insurance and business services ‘not elsewhere classified’.

2 Activities auxiliary to financial intermediation, real estate and other business services.

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.