New samples for monthly business cycle indicators

In September 2022, Statistics South Africa (Stats SA) implemented new samples for the following monthly surveys:

- P3041.2 – Manufacturing: Production and sales;

- P6141.2 – Wholesale trade sales;

- P6242.1 – Retail trade sales;

- P6343.2 – Motor trade sales;

- P6410 – Tourist accommodation;

- P6420 – Food and beverages; and

- P7162 – Land transport.

New samples for these surveys are implemented annually.

The impact of each new sample is explained in its corresponding statistical release (reference month July 2022 and publication month September 2022). This note is an update of a similar piece published in 2021 and provides a summary of the new samples drawn in 2022 as well as the recent history of implementing new samples.

Keeping samples and surveys up to date

Each sample is drawn from Stats SA’s business register, which Stats SA maintains using information provided by the South African Revenue Service. Maintenance of the business register includes changes related to new businesses, ceased businesses, merged businesses, and classification. Stats SA undertakes quality improvement investigations to keep its information up to date regarding the structures and activities of large and complex businesses. It is important, therefore, to draw new samples to keep surveys up to date with changes in the business register.

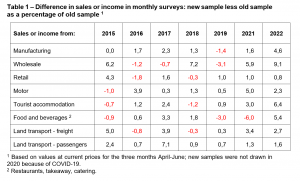

Differences in levels between the samples

For each of the surveys listed above, the new samples were run in parallel with the old samples for three months, namely April, May and June 2022. This is the same methodology that has been in use for many years. Comparisons between new and old samples are provided in Table 1. For example, in 2022 the level of manufacturing sales was 4,6% higher based on the new sample. The differences ranged from 0,8% (retail) to 9,1% (wholesale). Table 1 shows the history of level changes between old and new samples going back to 2015.

Linking the old series to the new

For most users, the most useful and interesting statistics from monthly business cycle indicators are the growth rates rather than the actual values of sales or income. Putting the old series together with the new series without linking the two would distort growth rates, whether the growth rates are calculated month-on-month or year-on-year, at current or constant prices, or using seasonally adjusted or unadjusted data. The greater the difference between the two samples, the greater the distortion in growth rates would be if there were no linking.

Consequently, Stats SA revises the historical data by linking the old series to the new series using a simple formula:

Linking results in a continuous series between revised and new, such that the growth rates are not distorted by the change in sample.

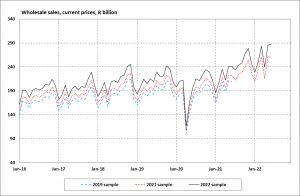

Figure 1 illustrates the effect of new samples in terms of levels, measured at current prices. Wholesale trade sales are shown for three different samples, namely 2019, 2021, and 2022. Normally the 2019 sample would have run until June 2020, but COVID‑19 prevented the implementation of new samples in 2020, so the 2019 sample was extended to June 2021. A new sample was drawn in 2021, which was used up until June 2022. The 2022 sample will be used until June 2023.

Figure 1 – Wholesale trade levels

In Figure 1 the 2021 sample lies approximately 6% above the 2019 sample, and the 2022 sample lies approximately 9% above the 2021 sample. However, the patterns for all three samples are similar over time, and as shown in Figure 2 the impact on historical growth rates is relatively small.

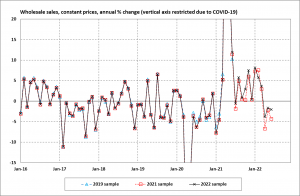

Figure 2 shows wholesale trade annual growth rates corresponding to the three different samples, all based on estimates at constant prices. The linking described above is performed at current prices, and the results are then deflated to arrive at constant prices. Thus the effect of linking carries through to constant prices automatically, with two important results for real growth rates. First, the growth rates are not distorted by the introduction of new samples. Second, the newly calculated growth rates are close to those published previously. Differences in growth rates (between the old and new samples) are partly the result of data cleaning processes related to technical issues such as the late receipt of data from respondents, the replacement of imputed values with actual values, and changes in respondents’ reporting structures.

Figure 2 – Wholesale trade growth rates

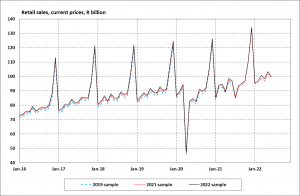

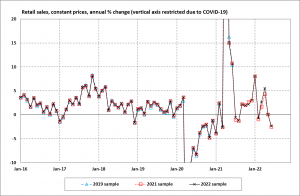

Figures 3 and 4 show the results for retail trade sales, and they work in the same way as Figures 1 and 2. The gaps between the samples in Figure 3 (retail) are much smaller than those in Figure 1 (wholesale), reflecting the differences between retail and wholesale that we see in Table 1 (for 2021 and 2022).

In Figure 3, note that the sharp upward spikes in retail trade are the high festive-season sales that we see every December (i.e. the data are not seasonally adjusted). Figure 3 also shows a sharp downward spike in April 2020, which is the impact of COVID‑19 and lockdown; a similar downward spike can be seen in Figure 1.

In Figure 4 note once again that new samples do not have much impact on historical on growth rates, which is the outcome of linking using formula [1].

Figure 3 – Retail trade levels

Figure 4 – Retail trade growth rates

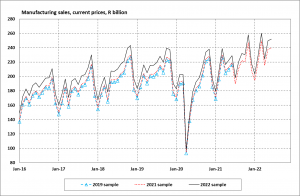

Figure 5 shows manufacturing sales based on the three different samples for 2019, 2021, and 2022. The 2022 sample lies above the 2021 sample, which lies above the 2019 sample.

The sharp upward spikes around October / November that we see each year are the seasonally high manufacturing sales ahead of the festive season. Figure 5 also shows the large economic impact of COVID‑19 in April 2020.

Figure 5 – Manufacturing sales levels

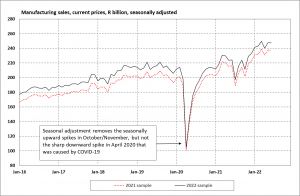

In contrast to Figure 5, Figure 6 shows manufacturing sales that have been seasonally adjusted, i.e. the seasonality has been removed. In Figure 6 we no longer see the upward spikes around October / November (because these are seasonal effects), but the sharp downward spike in April 2020 remains. In addition, Figure 6 shows that the effect of linking the old sample to the new sample carries through to the seasonally adjusted series.

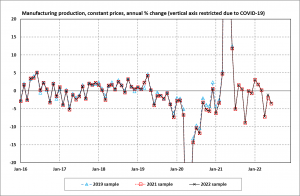

Figure 7 shows annual growth rates for manufacturing production, calculated from the manufacturing production index. Note that no linking is required for the production index when new samples are introduced, because although manufacturing sales are an important input for calculating production, the level of the production index is anchored at its base-year average of 100 in 2019.

Figure 6 – Manufacturing sales levels, seasonally adjusted

Figure 7 – Manufacturing production growth rates

Conclusion

New samples are implemented annually to keep monthly surveys up to date with changes in Stats SA’s business register, which is based on information provided by the South African Revenue Service. New samples typically result in changes in levels of sales and income, which would distort growth rates if the estimates based on different samples were not linked. Consequently, Stats SA runs parallel surveys to measure differences in levels caused by new samples, and uses this information to revise historical series such that the old series can be linked to the new series with no artificial breaks. This is important for growth rates for two reasons. First, growth rates are not distorted by changes in the sample, and second, newly calculated growth rates are close to growth rates previously published.

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.