PGM sales surge due to higher prices

Like all other commodities, South Africa’s production of platinum group metals (PGMs) was volatile in 2020 as miners tried to navigate the uncertainty and economic damage caused by the COVID-19 pandemic. Here is a snapshot of how PGM production, prices and sales fared during the year.

Supplies were adversely affected by COVID-19 related mine disruptions and processing-plant stoppages for several months at one of the country’s larger PGM operations.

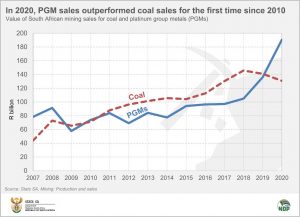

Despite a drop of 15,5% in PGM production in 2020, PGM sales increased by 40% as a result of higher prices.

PGMs consist of six metals: platinum, palladium, rhodium, ruthenium, osmium and iridium. Platinum, palladium and rhodium are the primary metals of significant economic value. Their demand is diverse across four main segments, namely automotive (superb catalytic properties), investment (coins and bars), fuel cells, and other industrial purposes.

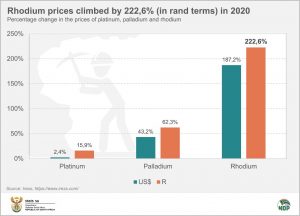

In 2020, prices for palladium (in US$ terms) increased by 43,2% and rhodium by 187,2%. In rand terms, rhodium prices climbed by 222,6%. These figures were calculated from data sourced from Iress.1

Of the six metals, rhodium is currently the most expensive. This is because rhodium is an extremely rare metal. It is also used to convert toxic gases in a vehicle’s exhaust system (such as carbon monoxide) into less harmful substances before they exit the exhaust pipe.

Platinum prices (in US$ terms) increased by 2,4% in the same year, and by 15,9% in rand terms.

With regard to platinum in particular, there was a sharp decrease in mining supply worldwide in 2020, as well as a fall in demand. Overall supply was down 17% for the year, while demand dropped by 7%, according to the World Platinum Investment Council.2

Rhodium and palladium sales account for 72,7% of the PGM basket in Stats SA’s Mining: Production and sales release, and platinum accounts for the balance. A decade ago, platinum accounted for 68,1% of the sales split.

In South Africa, the PGM sector is the largest contributor to mining in terms of sales. In contrast, coal is the most significant component of mining in terms of value added, accounting for 25%. For the first time in the last decade, PGM sales overtook those of coal to become the most significant contributor to total mining-industry sales, reaching R190 billion in 2020. This was more than the value of iron ore and gold sales combined.

The last time a similar development occurred was between 2001 and 2008 during the platinum price boom.

How long will the current bull market last? No one knows, but the World Platinum Investment Council expects demand to increase in 2021 on the back of a global economic recovery, particularly in the automotive and jewellery industries.

Stats SA will continue to report on production and sales figures at home, providing valuable insight into one of the most important PGM mining centres in the world.

For more information, download the latest Mining: Production and sales release here.

1 Iress (visit their site here).

2 World Platinum Investment Council, Platinum Quarterly, 10 March 2021 (read here).

Additional mining data are available from the Department of Mineral Resources and Energy (DMRE) (visit their site here).

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.