Business under lockdown: Pressure might be easing

During the final two weeks of Level 5 lockdown, almost half of the businesses responding to our impact survey indicated that they had temporarily ceased trading. During Level 4, this fell to one-fifth, according to a follow-up survey.

Other indicators from the Level 4 survey show a similar pattern as the economy returns to full functionality. Only 9% of businesses were operating at full capacity during Level 5. This increased to just over one in four (26%) during Level 4.

Access to materials and goods also eased, with 27% of firms able to get the materials, goods and services they needed while under Level 4 (rising from 10% under Level 5).

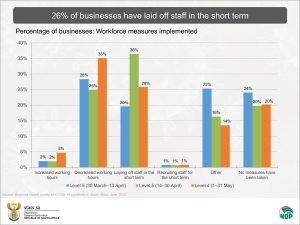

In terms of employment, 36% of firms indicated that they had laid off staff in the short term under Level 5, reducing to 26% under Level 4.

The proportion of businesses who expected their workforce size to decline dropped from 46% to 27% between the 2nd and 3rd surveys.

There was also an increase in the level of confidence as reported by the respondents. Under Level 5 lockdown, 14% were confident that their businesses have the financial resources to continue operating through the pandemic, increasing to 36% under Level 4.

During Level 5, 7% of firms indicated that they could survive for longer than three months without any turnover, edging up to 13% under Level 4.

Although this is cause for some cautious optimism, other indicators show that economic conditions are still tough. When asked about turnover, 90% of firms reported turnover below their normal range under Level 5. This edged only slightly lower to 84% under Level 4.

The struggle for turnover reflects the extent to which firms are reaching out for help. Under Level 5, 30% of firms indicated that they were planning to take advantage of government relief schemes. This increased to almost 40% under Level 4, possibly the result of businesses beginning to assess the full impact of the lockdown.

The Level 4 survey was the third round of Stats SA’s COVID-19 business impact survey, covering the period 1 May to 31 May. The first two rounds were conducted during Level 5, with the first round covering the period 30 March to 13 April1 and the second taking place from 14 April to 30 April.2

The third round solicited responses from 1 079 businesses. This was lower than the number of responses in the second round (2 182) but higher than the first round’s tally of 707.

When interpreting the results from all three rounds, readers should keep in mind that the results reflect the perceptions of a limited number of respondents.

The strength of the data is that it provides a quick snapshot and valuable economic insight – in close to real-time – into the impact of the COVID-19 pandemic on the South African formal business sector.

Download the complete report for the third round here.

1 The complete report for the first round is available for download here. A summary article covering the results is available here.

2 The complete report for the second round is available for download here. A summary article covering the results is available here.

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.