COVID-19: Nine in ten businesses report reduced turnover

The second wave of Stats SA’s COVID-19 business impact survey provides an update on how South African businesses are currently faring under lockdown.

The first impact survey covered the period 30 March to 13 April 2020, and the results were published on 21 April.1 The survey asked firms in the formal sector how the COVID-19 crisis was affecting their operations in terms of turnover, trading, workforce, imports and exports, purchases, prices, and business survival.

Stats SA quickly followed up with a second survey, covering the period 14 April to 30 April 2020. The number of responses for the second round was much larger, covering 2 182 businesses compared with the first survey’s tally of 707 businesses. The scope for the second survey was also expanded to include the agriculture and hunting sectors.

The complete report for the second survey is available here for download, but the following are a few of the key results:

- Turnover: The second survey showed that nine in ten (90%) responding businesses’ turnover was lower than their normal expected range, up from 85% in the first survey. The following industries experienced a rise in the percentage of firms reporting lower turnover: electricity, gas and water supply; mining; community, social and personal services; trade; transport, storage and communication; and manufacturing.

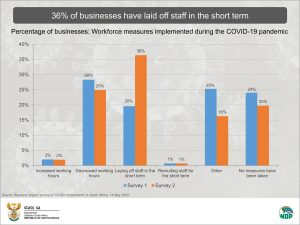

- Workforce: Just over one-third (36%) of firms indicated that they were laying off staff in the short term as a measure to cope with the COVID-19 pandemic. This is higher than the 20% reported in the first survey. One in four firms (25%) indicated that they were decreasing working hours, down from 28% in the first survey.

- Trading activity: Almost half (48%) of businesses reported a pause in trading in the period 14 April 2020–30 April 2020, nearly unchanged from 46% recorded in the first survey. Almost one in ten (9%) businesses indicated that they had ceased operations permanently. The industries with the highest percentage of firms permanently closing their doors include construction (14%); community, social and personal services (12%); and agriculture, hunting, forestry and fishing (12%). When asked if they would operate during the level 4 lockdown, 56% of responding businesses indicated that they would continue to do business.

- Business survival without turnover: 30% of respondents indicated they can survive less than a month without any turnover, while over half (55%) indicated that they can survive between 1 and 3 months. Only 7% can survive for a period longer than 3 months.

When interpreting the results from this survey, readers should keep in mind that they reflect the perceptions of respondents and are based on limited responses.

The strength of the data is that it provides a quick snapshot and valuable economic insight – in close to real time – into the impact of the COVID-19 pandemic on the South African formal business sector.

If you missed the link in the article above, the complete report for the second survey is available here.

1 The complete report for the first survey is available for download here. A summary article covering the results is available here.

Similar articles are available on the Stats SA website and can be accessed here.

For a monthly overview of economic indicators and infographics, catch the latest edition of the Stats Biz newsletter here.