Counting the costs of Valentine’s Day

You’ve got no one to blame except yourself. Admit it. You totally forgot about Valentine’s Day. Now that it’s just around the corner you’ve got to come up with something fast!

It was months ago when you and your significant other agreed that it would be your turn this year to do something special. You say to yourself that in the rush of starting out 2018 it just slipped your mind. But, in hindsight, all it would have taken was to set a reminder on your phone.

You grimace as you look in your wallet, realising that you used your credit card a tad too much in December. Ruefully, you think back to all those piña coladas you ordered on the beach.

No time; little money. You swallow hard, realising that you might be in trouble.

But there is hope. Maybe, just maybe, you can put something magical together for Valentine’s Day in the time that you have with the budget available.

It’s at this moment that you pull out the latest inflation data. Stats SA collects thousands of prices every month for a wide range of consumer goods and services.1 The prices are used to calculate the Consumer Price Index (CPI). Detailed price data are available, on request, for about 360 consumer goods.

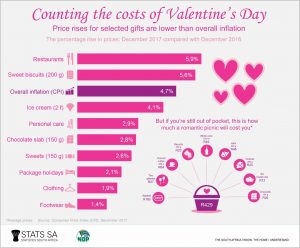

You look through the list of goods, keeping an eye open for anything than can be regarded as a romantic gift or activity. There are some items that are not currently in the inflation basket, such as flowers and jewellery. However, other amorous items such as restaurants, package holidays and chocolate are included (click on the image to enlarge).

Any viable options?

A romantic, candlelit dinner at a restaurant might seem like a good choice, but according to the data, the cost of dining at a restaurant went up by 5,9% in December 2017 compared with December 2016 – higher than overall inflation.

Images come to mind of the last time you and your significant other had a romantic night out at a restaurant. It didn’t go that well: heartburn from food that was far too spicy, the smartly dressed but morose waitron, and the overly enthusiastic violin player who just wouldn’t take a hint.

Nope, moving on…

You’re pleased to see, however, that the price rises of most gifts and activities have remained below overall inflation. The average price of a 150 g chocolate slab, for example, was only 2,8% more expensive in December 2017 than in December 2016.

You glance at your wallet again, and then back at the price list. A lightbulb goes off…

A romantic picnic!

You look again through the list and pick out possible items that can fill a picnic basket for an adventurous outing with your significant other. Biscuits, wine, ground coffee, glasses, chocolate, a blanket, rolls, ham, and cheese. Perfect! A picnic it shall be.

According to Stats SA’s data, the total average price of your basket will be about R430.2 This, of course, excludes the items that don’t appear on the list but that will definitely be included, such as flowers, a gift card, and those naughty cupcakes you bake so well.

Now armed with a plan, you breathe a sigh of relief. You get up, grab your wallet and head for the door. Time to put your plan into action. But just before you reach the door, you take a second to set a reminder on your phone for the next time it’s your turn for Valentine’s Day. You won’t make the same mistake again.

1Download the latest Consumer Price Index (CPI) release here.

2The key word to keep in mind when interpreting these prices is average. Stats SA visits retail outlets around the country every month to record thousands of prices. The prices mentioned here are not necessarily the exact prices that you will see in the store, but are averages of prices recorded for various items.